22 October 2025

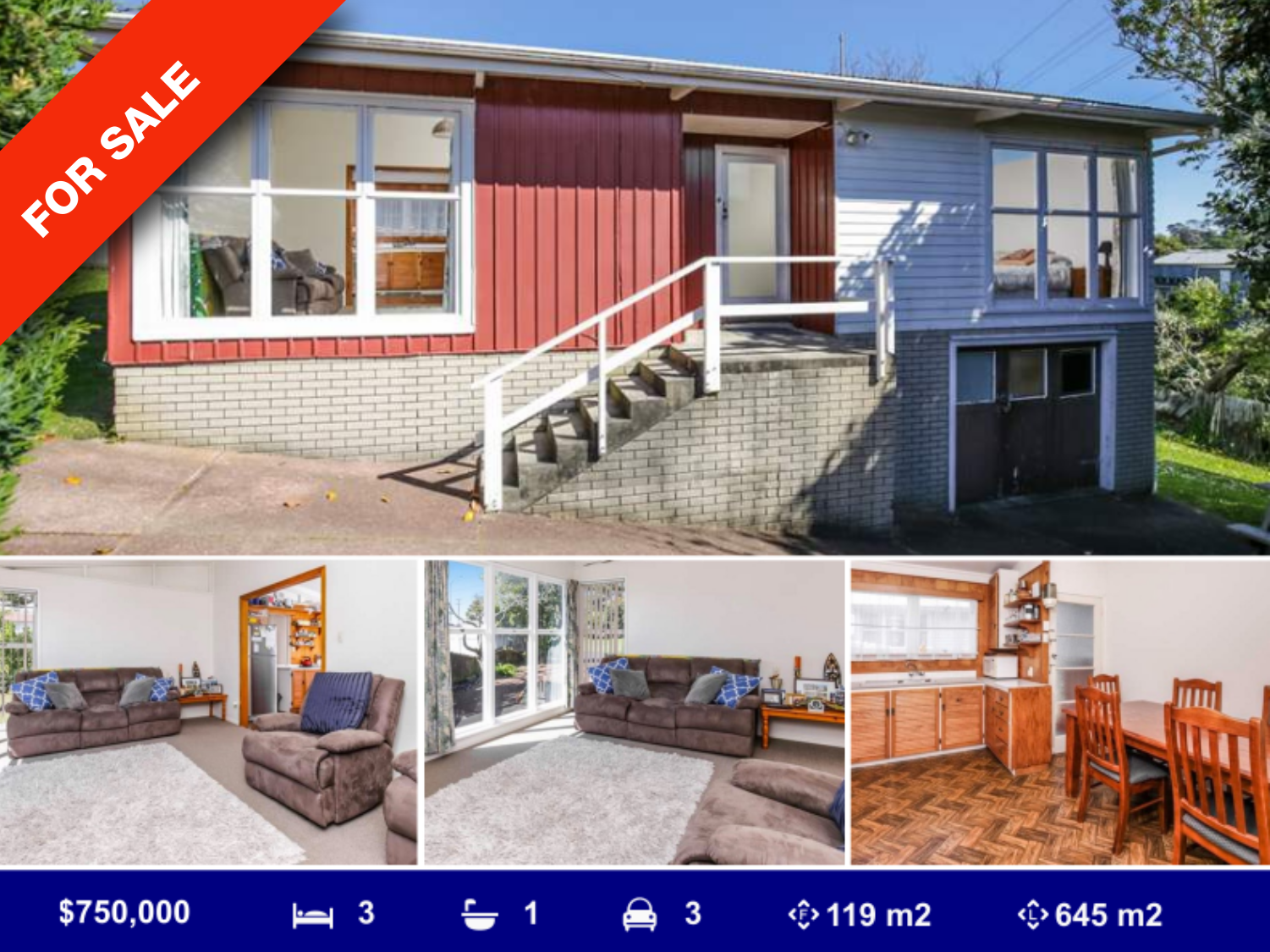

The numbers in the REINZ report do not accurately reflect the rapid changes that are taking place in the market. We have just sold 3 Falkirk Street in Blockhouse Bay. We had over 10,000 enquiries for the property, over 100 enquiries, three offers within two weeks and a back-up offer. It sold and settled within 6 weeks. There are three reasons for this:

- The high level of interest was due to how we positioned the property in our marketing.

- The number of first home buyers, investors and flippers entering the market is very high.

- The vendor was willing to meet the market.

Our job is to create interest with a strategic marketing plan and reach the widest audience of potential buyers. Once that interest has been created, the property will be sold.

If you are thinking of selling, talk to us about what our strategic marketing plan will be. Talk to other professionals as well. Then choose the plan that makes the most sense.

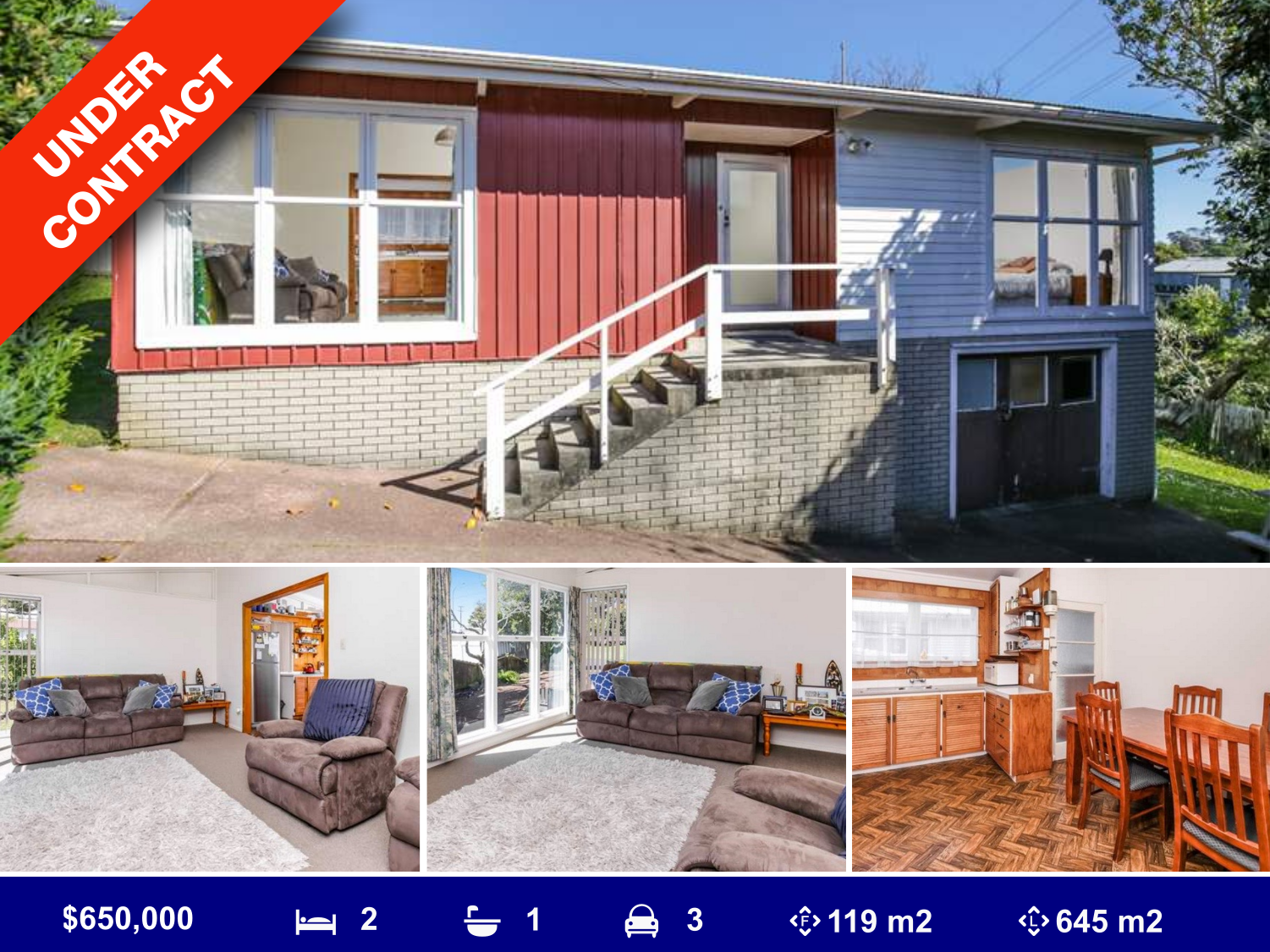

SOLD

3 Falkirk Street, Blockhouse Bay

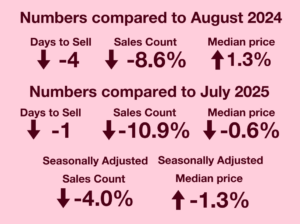

Market momentum slow yet steady

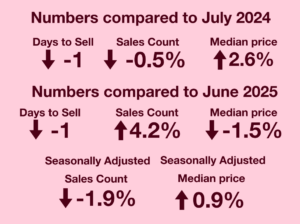

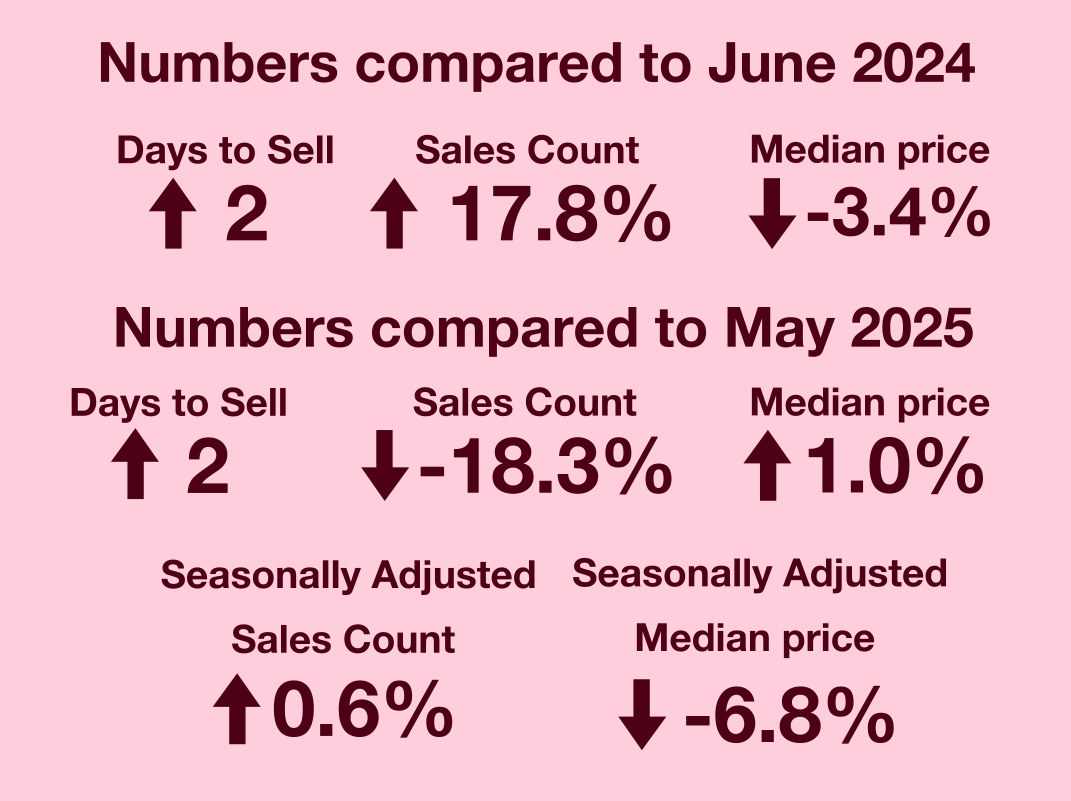

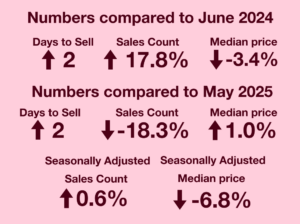

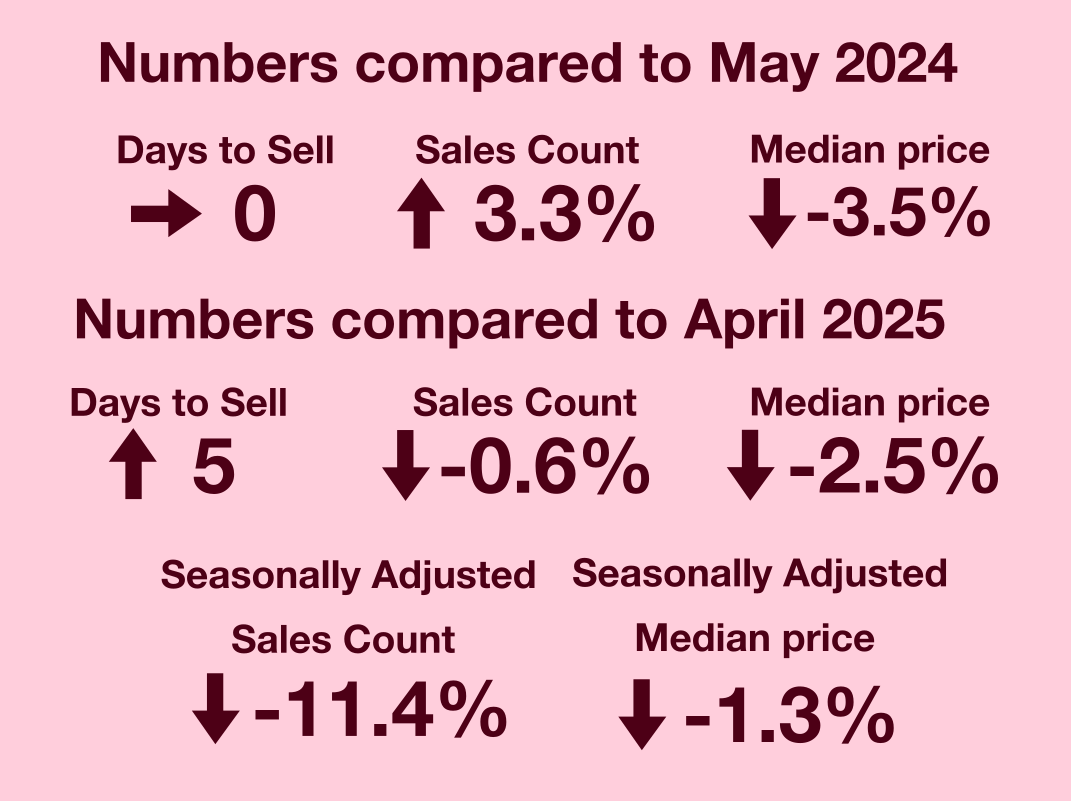

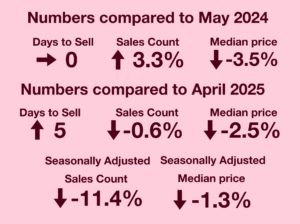

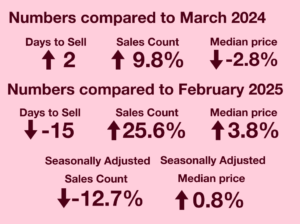

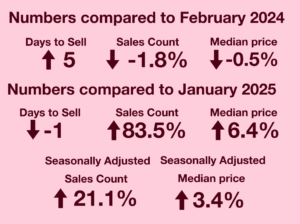

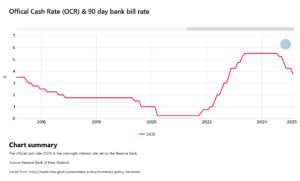

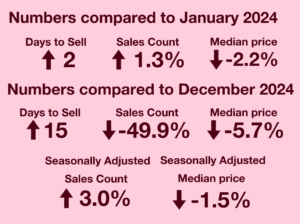

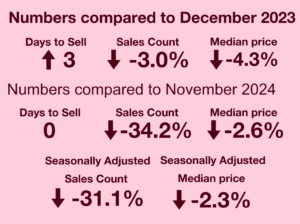

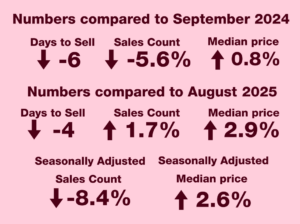

As per the latest REINZ September 2025 property report, the data shows a 0.8% increase in the Auckland median sale price, compared to the same period last year and a 5.6% decrease in the sales count. Compared to the previous month, the Median Price is up 2.9% and Sales Count is up 1.7%. REINZ has stated that, “Local salespeople are cautiously optimistic that confidence amongst all buyers will increase in the coming months, which might lead to increased sales.”

To view the full REINZ report, click here.

Property Investor Insights September 2025

Economist Tony Alexander shares his insights in his latest Property Investor report, which compiles the response he has received from 259 property investors. The results show the following:

- Over half of landlords say they plan holding their property for at least ten years or never selling it.

- Investors looking to make another purchase remain strongly focused on existing dwellings rather than new ones.

- The average rent rise which landlords will attempt to achieve over the coming year is on a downward trend.

To view the full report, click here.

NZHL Property Report August 2025

Economist Tony Alexander shares his insights in his latest NZHL Property report, which compiles the response he has received from 253 real estate agents. The results show the following:

- A solid buyer’s market remains in place with evidence of more vendors entering the market to sell.

- Young buyers continue to have a strong presence, but investors appear to be net sellers of property with a trigger for some being when a current tenant moves out.

Prices are generally still seen as falling according to agents, with FOMO remaining at low levels yet many vendors still hoping for 2021 prices.

To view the full report, click here.

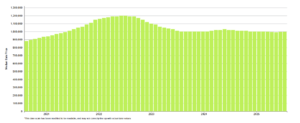

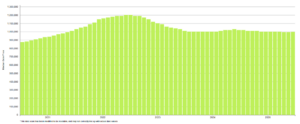

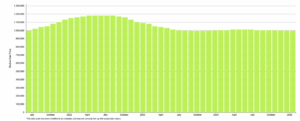

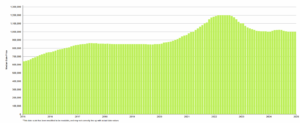

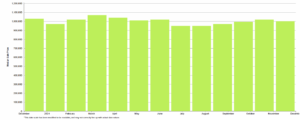

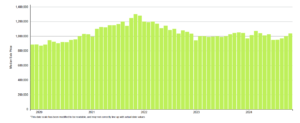

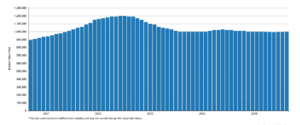

Auckland median sale price movement over last 5 Years (September 2020 – September 2025)

For Rent

$650 Per Week

3 beds, 2 baths, 1 carport

2/82 Roberts Road, Te Atatu South

$650 Per Week

3 beds, 1 bath, 2 carports

Graph is based on statistical data published by REINZ.

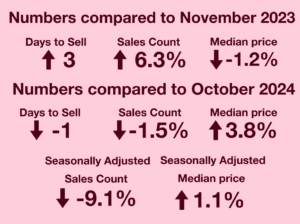

Our Partners