07 March 2025

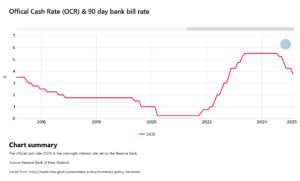

Property owners are obviously pleased about the reduction in the OCR and the resultant reduction in mortgage interest rates by the banks. The real effect on the market will be felt in the next few months as property owners come off their fixed term rates. There is always a lag between a policy announcement and the market reaction to it. But one can safely say that a downward movement in mortgage rates will have an immediate and positive effect on market sentiment. My friend Duane is my go-to person when I want to gauge market sentiment. He does pre-purchase building inspections for property buyers. I asked him yesterday if he was busy. He said he was very busy since the OCR announcement and there seemed to be a sense of urgency among buyers. So there you go!

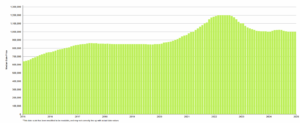

The graphs below shows how the OCR has moved over the last 10 years and how the Auckland median price has moved over the same period. As you can see there is a direct and inversely proportional relationship between the OCR and price. The OCR was at 3.50 in March 2015 and is now at 3.75.

The good news for property owners who bought their properties at least 10 years ago is that the median price in Auckland has gone up from $650,000 to $1,000,000. This represents a capital gain of almost 50% in 10 years.

Auckland median sale price movement over last 10 Years (Jan 2015 – Jan 2025)

Graph is based on statistical data published by REINZ.

Market Confidence Grows with the New Year

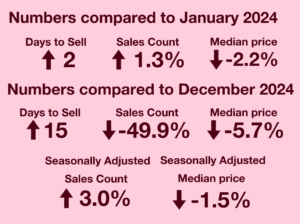

As per the latest REINZ January 2025 property report, the data shows a 2.2% decrease in the Auckland median sale price, and a 1.3% increase in the sales count compared to the same period last year. Compared to the previous month, the Median Price is down 5.7% and Sales Count is down 49.9%. REINZ reports that there are signs of a steady market alongside a sense of uncertainty balanced by a growing expectation that activity will slowly improve over the next few months.

To view the full REINZ report, click here.

Property Investor Insights February 2025

Economist Tony Alexander shares his insights in his latest Property Investor report, which compiles the response he has received from 287 property investors. The results show the following:

1. An increasing proportion of investors are considering reducing the size of their real estate portfolio.

2. Concerns about the potential for house prices to rise have increased while optimism regarding the extent of interest rate declines has eased.

3. Landlords continue to report difficulties in securing good tenants, but banks are perceived as being willing to advance funds.

4. More investors are considering selling.

You can read the full report here.